Investing in Bitcoin and the Power of Dollar-Cost Averaging

Investing in Bitcoin (BTC) has gained tremendous traction in recent years as awareness of its potential as a long-term store of value continues to grow. For many, it presents an attractive alternative to traditional savings accounts, pension funds, or ISAs (Individual Savings Accounts), especially given the current landscape of inflation and economic instability. One effective strategy in Bitcoin investing is dollar-cost averaging (DCA), a disciplined approach that can mitigate the volatility of this emerging asset class.

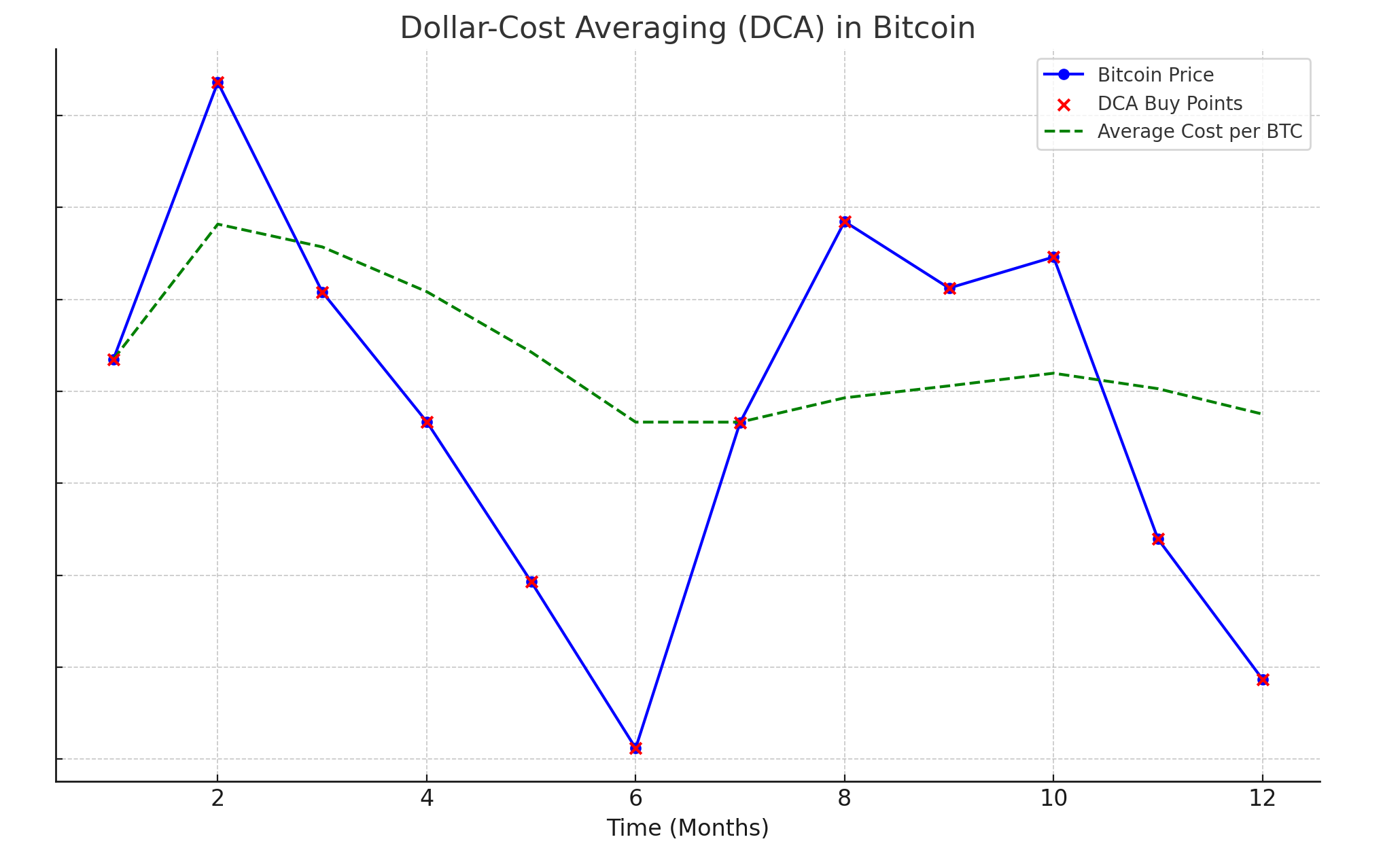

The Concept of Dollar-Cost Averaging

Dollar-cost averaging involves consistently investing a fixed amount of money into an asset at regular intervals, regardless of its price. This approach allows you to buy more when prices are low and less when prices are high, ultimately averaging out your cost per Bitcoin over time. With Bitcoin’s historical price fluctuations, DCA can help reduce the emotional toll of trying to time the market and enable individuals to take a long-term view on their investments.

Bitcoin as a Future Value Store

As inflation continues to erode the purchasing power of traditional fiat currencies over the next decade, the appeal of Bitcoin as a hedge against inflation cannot be overstated. Unlike fiat currency, which can be printed at will by central banks, Bitcoin has a capped supply of 21 million coins, making it a deflationary asset. Investing in Bitcoin offers the possibility of significant gains that may outpace inflation, thus providing superior long-term returns compared to traditional savings accounts.

For instance, a £50,000 lump sum saved in a typical account may lose value in real terms due to inflation, whereas investing that same amount in Bitcoin could yield exponential growth. Historical data suggests that Bitcoin has consistently appreciated over the long term, making it an enticing prospect for those looking to build wealth.

Selling Bitcoin to purchase a Property

One common strategy among Bitcoin investors is to realize profits and reinvest in traditional assets like real estate. While diversifying into property may seem prudent, it’s essential to consider the inherent differences in control and potential growth between these two types of investments.

When you sell a portion of your Bitcoin to fund property purchases, you’re converting an asset that has shown remarkable growth potential and liquidity into real estate—an asset that often requires substantial upkeep and carries associated risks such as maintenance costs and the unpredictability of the rental market.

In the UK property market, while real estate can be lucrative, it often requires significant capital and time investment without the same potential for explosive growth as Bitcoin. Additionally, the ongoing management of properties can detract from the sense of control and freedom that comes with holding Bitcoin, particularly in times of market uncertainty.

Maintaining Control and Freedom

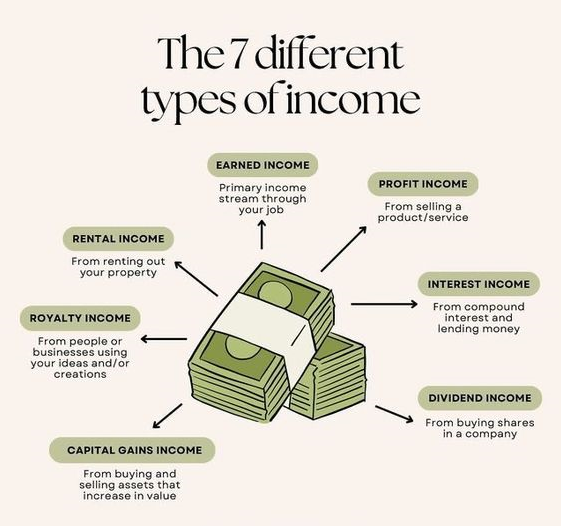

Rather than liquidating Bitcoin for property investments, a more strategic approach could involve holding onto your Bitcoin while using the profits (Rent) generated from your property business to acquire new properties including any other sources of income. This method allows you to maintain your investment in Bitcoin, which may benefit from ongoing market appreciation while simultaneously expanding your real estate portfolio with profits from your operational successes.

This dual approach not only preserves the upside potential of Bitcoin but also provides the financial flexibility to leverage profits for growth in your property investments without diminishing your Bitcoin position. In this way, you don’t compromise control over your financial future but rather enhance it through thoughtful management of diverse assets.

Conclusion

In an era where traditional savings methods struggle to keep up with inflation, investing in Bitcoin through strategies like dollar-cost averaging presents a compelling alternative. By viewing Bitcoin as a long-term store of value akin to a pension or savings account, investors can harness its growth potential while enjoying benefits like liquidity and control.

Instead of selling Bitcoin to invest in property, consider the merits of holding Bitcoin and letting your profits from real estate drive your portfolio expansion. This balanced approach provides a sense of freedom and control over your investments—an invaluable asset in today’s unpredictable economic climate.

Continue reading:

Written by: Callum Ide